The end of the year always brings many exciting milestones: trick or treating with little ones on Halloween, spending time with loved ones on Thanksgiving and Christmas, and preparing for the New Year. However, in 2024, one major event can potentially impact your estate plan the most: Election Day. In this year’s political race to nominate the 47th President of the United States, there are many issues being discussed. However, an impending legislative change can impose severe estate taxes, impacting millions of Americans previously unaffected. Here is a breakdown of what this new bill entails, and how the results on November 5th could change these new estate tax laws:

History of the Tax Cuts and Job Act of 2017 and the American Housing and Economic Mobility Act of 2024

On July 29, 2024, Democrats introduced the American Housing and Economic Mobility Act of 2024 before Congress. While this act covers various matters, one of the hallmarks of this legislation is a substantial change in the federal estate and gift tax.

The federal estate tax is a tax on the transfer of wealth from a deceased individual to their heirs or beneficiaries. In 2024, no federal estate tax is levied against a decedent’s estate unless it surpasses $13.61 million in value due to the Tax Cuts and Jobs Act (TCJA) of 2017. So, if you had under $13.61 million, your estate would pay no estate tax upon your death. But if you had over $13.61 million, your estate would be taxed at a rate of 40%. These numbers are set to expire January 1, 2026, unless Congress acts. Without a new law being in place, the exemption would be reduced to $5 million (plus inflation).

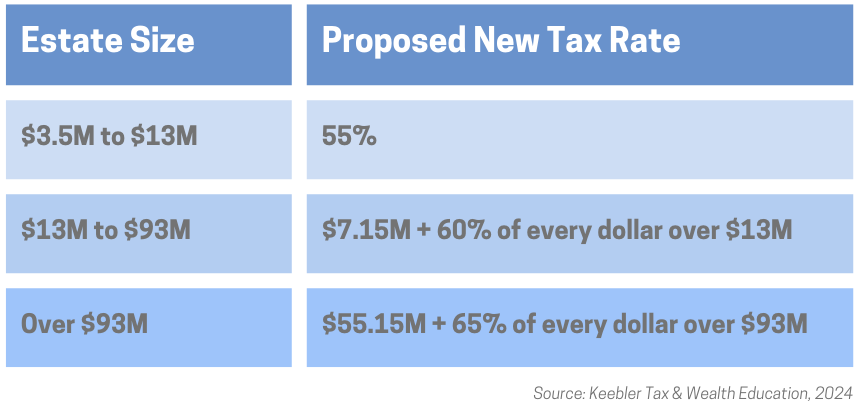

Under the currently proposed American Housing and Economic Mobility Act of 2024, the exemption would be reduced from $13.61 million to $3.5 million for individuals. The proposed bill also increases the estate and gift tax rate to 55% from 40% for estates under $13 million. For estates over $13 million, the estate tax increases to 60%. For estates over $93 million, the rate increases to 65%.

The bill also adds an additional 10% surtax to estates over one billion dollars.

How Does the Election Impact the New Estate Tax Laws?

There are two primary candidates on the Presidential ballot, Vice President Kamala Harris (D) and former President Donald Trump (R). Both candidates have varying estate tax proposals:

Harris has stated her full support and endorsement for the American Housing and Economic Mobility Act of 2024. If Democrats control both Congress and the presidency, the likelihood of this legislation going into effect in January 2026 is high.

Trump has suggested he would extend the current exemption and rate on estates, as set in the TCJA. By doing so, this would keep the $13.61 million threshold for the federal estate tax exemption (plus inflation) and the tax rate of 40%. However, a Trump victory does not mean the current threshold and tax rate would stay in place. To keep today’s current rates, an extension of the TCJA would either need to be voted upon by Congress, or new legislation would need to be approved by Congress.

Contact Crow Estate Planning & Probate to Create Your Tax-Favored Estate Plan

While we do not know which candidate will ultimately prevail, the federal estate tax threshold is still set to drop at the end of 2025 from $13.61 million to $5 million (plus inflation). If you are a Tennessee or Kentucky resident whose estate is approaching or exceeding $5 million, it is important to meet with an experienced estate planning attorney to discuss your options with tax-favored estate plans.

Give our team at Crow Estate Planning & Probate a call today to schedule your free consultation.

Thomas Steelman

Thomas Steelman